Post appeared in CrowdfundInsider on Jan. 17, 2015

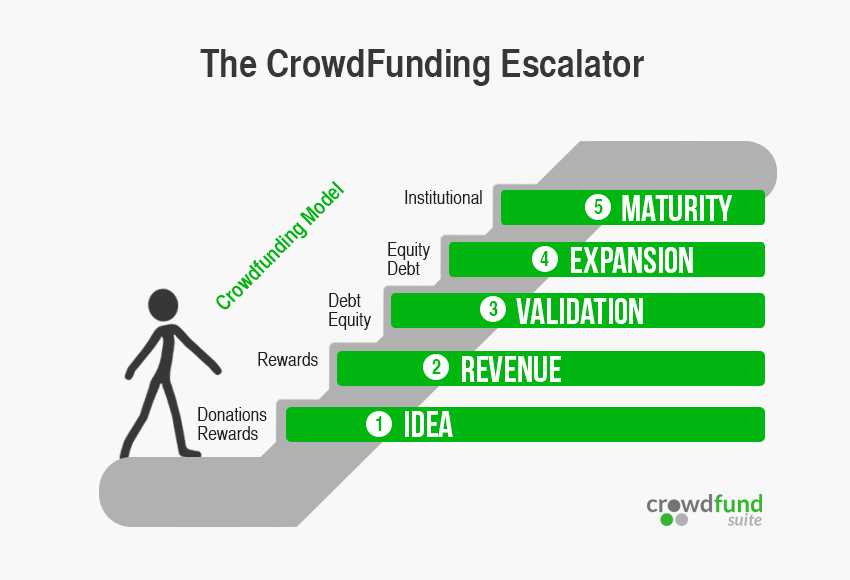

As Alternative Investments emerge as an exciting new asset class for institutions and retail investors, entrepreneurs have a wide choice of options on crowdfunding model and platform for their campaign. What are the key factors for Entrepreneurs to consider in their decision? Introducing the concept of the Crowdfunding Escalator. The escalator is a device to help select the right model and platform strategy for entrepreneurs as their business grows over time. Next stop – The Top!

What key things should projects look for in a platform? In other words, what factors markedly distinguish one platform from another?

In terms of platform selection, there are 3 key factors to consider for firms raising capital – A) Business stage, B) Business Sector and C) Platform track record:

A) Business stage

The amount of capital you need and the stage of your business are critical to a decision on the model to use and platform to select. As I first mentioned in the Globe & Mail, I use the analogy of a ladder or Funding Escalator where firms move up the escalator over time and as their funding requirements increase. The models tapped into by entrepreneurs typically raise different amounts – in the range of:

Donations < $10,000

Rewards – $10 – $100k+

Lending – $25-$150k

Equity – $250k – $3M+

The Crowdfunding Escalator Concept:

Step 1 – Idea

Early stage capital is often marked by founders picking up the expenses directly or turning to love money. Could consider a Donation campaign to better administer the friend and family support and create awareness or a Rewards campaign if demand for Pre-Order of their product or service is judged to exist – like was the case for Vancouver Sausage House Bestie.

Step 2 – Revenue

A real business activated and operating with revenues. Can consider turning to the crowd to supplement cash flow and expansion needs with a Rewards campaign if their business is well suited to this model like hardware, film or social ventures. The marketing benefits are as valuable as the funds.

Step 3 – Validation

Break-even and validation of business model over a couple of years. Could consider Lending if they meet the criterion and have a good credit rating. The benefits can include paying lower rates than the banks while creating community advocates from the local investors they are borrowing from. Plus, equity can be very expensive at this stage given that valuations are not maximized.

Step 4 – Expansion

Rapid scaling via new locations, increased inventories, more staff or increased capital investment to drive production, service delivery and revenues. This expansion phase can be a good time to consider Equity as the valuations will be much more favorable. Accredited investors have proof of your ability to run your business and may be quite interested in participating in the benefits of your growth. Debt crowdfunding or traditional bank lending or Angel investment may also be options to consider given your maturation to fundable status in their eyes. The latter two do not provide the marketing benefits though.

Step 5 – Maturity

This is where you can comfortably fund the business from cash flow after 5+ years in operation. Your goals will drive your model decisions from here. Do you want to consider exit? Still keen on growth? Entering new markets? Your options are many at this stage of your business, possibly including institutional sources via crowdfunding or traditional financing or venture capital firms if you fit their criterion.

Some firms still turn to Equity crowdfunding at this stage preferring to avoid the control issues and forced exits common in the venture capital arena. Standards are starting to emerge like term sheet templates that will manage issues like shareholder management of many smaller investors.

B) Business Sector

While these are not hard and fast rules some general guidelines can be seen by this Infographic from InvestNextDoor. Rewards have proven very successful for the Arts, Charities and gadgets or new technology ventures. Equity has worked for hot startups that would have attracted angel investors with old-fashioned pitches before the advent of crowdfunding (e.g. the cream of the crop) or for corporations or firms at the Expansion or Maturity phases described earlier. Lending is a newer option that seems very well suited to Main Street businesses that have hit the expansion phase after 2+ years and want to create advocates while they borrow. This Infographic from InvestNextDoor provides more insights on costs and timelines and other considerations when choosing models.

C) Platform track record

Do your research on the platform options. While raising capital from the crowd is a brave new world and some new platforms will succeed, you can reduce your risk by looking for a track record of success and asking questions like those below:

How much money has been raised by projects similar to yours?

How many projects have raised funds?

Do they claim to serve your niche? Can you find proof?

Do they have evident financial backing?

Does the executive team have any background in crowdfunding or venture capital?

Does the platform feature set support my marketing plans for my campaign? E.g. social media integration etc.