How Community Fundraising is Helping Brewery Owners Overcome Financial Hurdles

Whether you are an established brewery owner, or you are looking to open a beer-making business, chances are you have a simple dream to make money doing something you love. At some point that dream will hit a reality check: how to raise capital for a brewery.

The costs associated with equipment, ingredients, staffing, and marketing can test the resilience of even the most passionate brewmasters. Traditional financing methods, such as finding investors or taking out a loan, can provide solutions.

But what if there was a way to alleviate these financial pressures and harness the power of your most valuable asset — your community? In this article, we explore a new paradigm for the industry: how to tap your community capital. We will show how engaging people who share your passion for craft beer can build a financial foundation that is rooted in mutual support and enthusiasm.

The Importance of an Exit Strategy

Before we explore community capital, we want you to think about your exit strategy. It might seem counterintuitive to think about the end at the beginning, but having a well-thought-out exit strategy is essential, especially in the early stages of your venture adventure.

You may think, “I’ve only been doing this for a few years. I’m not ready for an exit”. The thing is, if you want to optimize the return on your sweat equity, you should have a plan for the day you want to get out.

An exit strategy is about having an end goal. It’s about securing the rewards of your dedication and transforming your passion into a profitable legacy. Whether you want to create something that is attractive to a buyer or you want to foster a legacy that will continue to thrive, even as you move on to your next adventure, it is important to have an idea of where you want to end up. After all, every journey needs a destination.

Once you have a clear vision for your brewery’s future, you can decide on the best way to achieve it.

Recipe for a Craft Beverage Business

Making a successful craft beverage business is a lot like following a recipe. It starts with finding a gathering spot – your place in the market. Are you catering to an underserved niche or joining a thriving district? Having the right brewing and packaging equipment, a bustling tasting room, creates a space where your craft and the community connect.

Next, add a blend of “the right people”. A hardworking team, reliable suppliers, efficient distributors, and of course, resilient founders. The right people who can do the job and who share your passion and vision for craft brewing.

Drop in some artisanal flair. Craft demands quality ingredients, creativity, and a keen sense of taste to distinguish your brand from the competition.

Finally, the most crucial ingredient in this recipe is your customers. Building a community that cares deeply about your brewery and its offerings is the secret sauce to your success. Ultimately, your community capital or the equity you build with them, will determine your final ROI – your reward.

Traditional Fundraising Paradigm

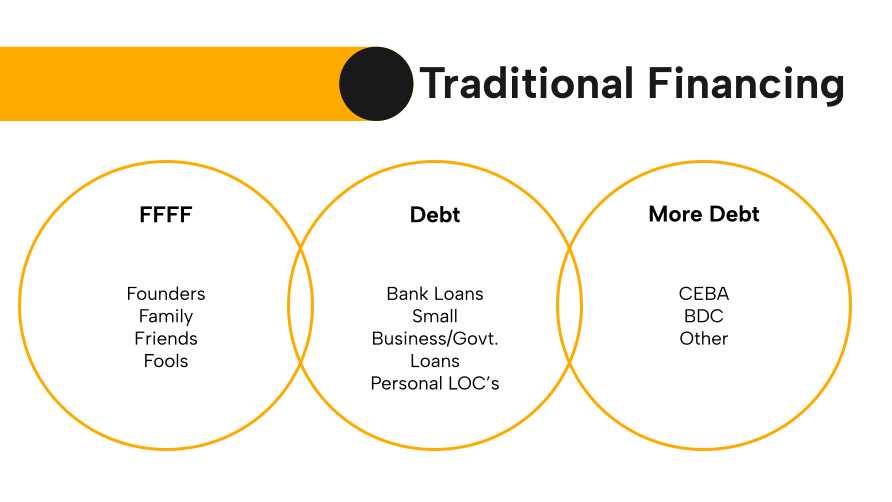

Financial requirements for equipment, facilities and working capital can run into the millions. From conversations with our Brewfundr clients, in almost every case their venture capital journey followed something we call the Craft Drink Capital Paradigm.

This model often starts with the “FFFF Round”. FFFF stands for founders, family, friends, and fools – utilizing funds from personal savings, loved ones, and perhaps some of your dad’s thirsty friends.

As the brewery begins to take shape and the financial needs escalate, the next step usually involves debt. Owners seek bank loans, small business loans, or resort to personal lines of credit. The challenge here is to manage the debt effectively while ensuring it fuels growth without becoming an overwhelming burden.

Christopher Bjerrisgaard, owner of Small Gods Brewing Co., in Sidney, BC, shared his experience with CrowdfundSuite. By balancing cash flow from operations with strategic restructuring of personal assets, Christopher and his partner successfully transitioned their debt into a more manageable shareholder loan format. This move was instrumental in reducing the high costs associated with traditional bank loans. Sadly not every brewery is as successful at navigating this transition.

Challenges to the Traditional Paradigm – Sound Familiar?

The Craft Drink Capital Paradigm presents several challenges that brewery owners must overcome. Every owner who goes this route has to manage:

- Seasonality: The “Canadian Curve”, where cash flow can become particularly tight during the spring and fall often leads to difficulties with staffing levels and service quality. The need to attract and retain customers during these leaner periods means establishments need to ramp up marketing efforts, which in turn can lead to increased operational costs and potentially more debt.

- Cost of Financing: In the realm of small business loans, interest rates can range from just under 6% to as high as 29%, making debt a costly affair. While breweries may manage to cover debt service and operational cash flow, the high cost of financing can severely limit their ability to access capital for expansion, especially when trying to scale up operations.

- Competition: Compounding this challenge is the highly competitive nature of the craft beverage market. Brewery owners must constantly innovate to capture a greater share of their customers’ wallets, competing not only with other breweries but also with tap houses, cideries, wineries, and restaurants. The competitive landscape can often lead to market consolidation.

A New Paradigm: Community Capital

While the traditional methods have inherent challenges there is an untapped resource that can help your business grow organically: Brewfundr’s Community Capital Program. This innovative strategy shifts away from conventional methods of financing to more engaging and community-centric models, opening up a world of possibilities for brewery owners.

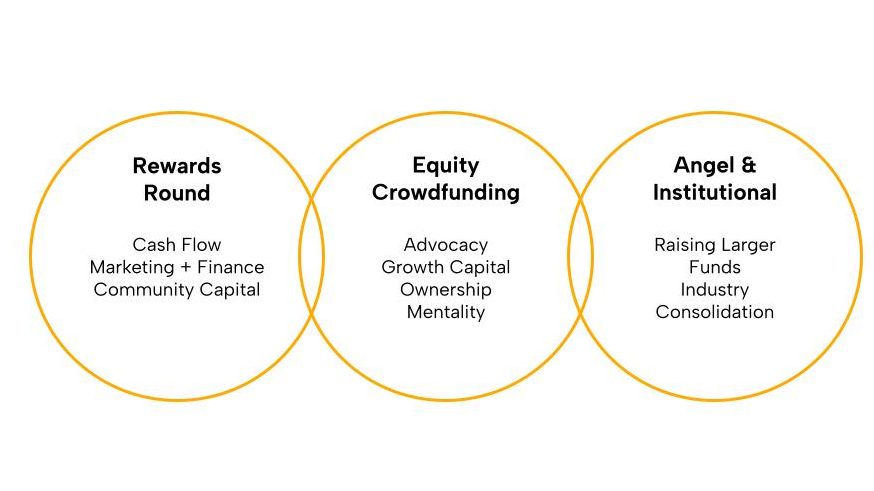

The program consists of three main rounds:

- Rewards Round: This consists of launching creative pre-paid programs that boost cash flow but also strengthen customer loyalty. Successful examples include Beer for Life programs or exclusive Stein Clubs. These initiatives provide immediate financial benefits by generating upfront cash, but they also create a sense of belonging and loyalty among customers by making them a part of your brewery’s story.

- Equity Crowdfunding: Taking the idea of ownership among customers a step further, equity crowdfunding involves getting a group of people to become investors in your business. The beauty of this approach is that it fosters a deeper sense of ownership among your patrons and turns them into passionate brand advocates. Having a stake in your brewery, means these customer-shareholders are more likely to not only stay loyal to your business but also to promote it, increasing your reach and influence.

- Angel Round: When the time comes for significant expansion and scaling, having the backing of your community and a solid foundation laid by earlier funding rounds means your brewery becomes an even more attractive proposition for angel investors and institutional funds. These investors often bring not just capital but also valuable experience and networks, which can be instrumental in propelling your brewery to new heights.

Together, these funding rounds form the pillars of the Community Capital paradigm, offering a dynamic and interconnected approach to financing. By embracing this model, breweries can navigate financial challenges more effectively, foster a strong sense of community, and set the stage for sustainable growth and success.

Benefits of Tapping Community Capital

Embracing the Community Capital model offers breweries significant benefits, including vital cash flow injections to mitigate seasonal fluctuations and an increase in customer loyalty, sales, and value. This approach not only strengthens community ties, enhancing potential exit strategies, but also uniquely blends marketing strategies with financial growth.

Rewards Round

A great example of successful rewards programs can be found at Macaloney’s Island Distilling and Twa Dogs Brewery. The Saanich, BC, site has employed several crowdfunding-inspired strategies to enable growth including a Whisky for Life program, a Whiskey Academy, and a Cask Program, where punters can participate in the whisky making process, design their own label, and choose a cask.

Nathaly Nairn of Windfall Cider, inspired by a women-led entrepreneurial group, launched ‘Cider for Life’ to identify and reward her most dedicated fans, resulting in significant cash injections and an enviable marketing boost. Similarly, Ryan Sholz from Shaketown introduced ‘Beer for Life,’ offering weekly beers for $350, capitalizing on customer loyalty to make Shaketown a preferred destination over local competitors.

Another innovator is Vancouver Island Brewing which launched a Wallet Pass program powered by FOBI that enables them to offer loyalty incentives, vouchers, and tickets through an app. These initiatives not only bolstered their finances but also solidified an army of loyal customers.

Equity Fundraising Round

Equity crowdfunding is a highly effective way to cultivate a loyal fanbase by converting your customers into shareholders. This method offers more than an investment opportunity for your patrons, they also share in the brewery’s story and success, creating a community that actively participates in and promotes your growth.

BrewDog in Scotland is a trailblazer in equity crowdfunding. Dubbing their backers “Equity Punks,” they have raised more than £70 million with nearly 100,000 shareholders as of 2018. Closer to home, Persephone Brewing, Stone Brewing, Black Hops, and Here Today are all equity crowdfunding success stories. Persephone raised more than $1 million on crowdfunding platform Frontfundr after previous successful raises

Breweries can raise anywhere from $300,000 to $2 million by crowdfunding while increasing the valuation of their venture and attracting a wide array of investors at the same time.

Angel Round

The Angel Round in brewery financing marks a significant turning point, where the success of previous crowdfunding efforts sets the stage for attracting larger, institutional investors or strategically acquiring competitors. This stage of funding, potentially raising between $5 to $20 million, prepares breweries for the impending industry consolidation expected over the next decade. It poses the critical question to brewery owners: will they emerge as dominant players or remain small-scale operators?

Embracing this new funding paradigm allows brewery founders to significantly reduce their dependence on debt, alleviate the stress of financial commitments like payroll, and amass the capital necessary for substantial expansion. Whether it’s opening a pop-up tasting room, expanding off-site sales, adding new patios or equipment, launching a food truck, or establishing a second location, the Angel Round offers the flexibility and resources to realize these ambitions. It’s a strategy that not only ensures a more lucrative exit but also reflects the culmination of a brewer’s hard work and dedication to their craft.

Tap Your Community Capital Today

The journey to brewery success is no longer confined to traditional financial pathways. The Community Capital model, encompassing the Rewards, Crowdfunding, and Angel Rounds, presents a fresh approach to fundraising. It empowers brewery owners to leverage their most precious commodity: their passionate customers. This paradigm shift not only eases financial burdens but also fosters a deeply connected community around your brand, setting the stage for sustainable growth and a prosperous future.

Are you ready to embark on your crowdfunding journey? CrowdfundSuite is here to guide you through each stage of community capital with our specialized Brewfundr service. Whether you’re initiating a Rewards Round, launching an Equity Crowdfunding campaign, or stepping into the Angel Round, our expertise is tailored to help you maximize your brewery’s potential. Schedule a free consultation and start your journey with us today.